What the AAF taught us about the business of sports. XFL 2.0. The future of football.

By:

Chris Antonious

September 14, 2019

In April 2019, the Alliance of American Football (AAF) suspended operations in its short-lived season. Lasting less than 52 days since kickoff, the AAF was the shortest professional football season since the 1982 National Football League (NFL) season that was abbreviated due to a 57-day-long players’ strike.

The sack of the Alliance puts the business of sports in perspective on and off the field of yet another professional football league falling short of the goal line. Allow me to call the plays for a moment with binoculars from the press box. The sports industry is under review, and it’s time for the referees to evaluate what the market is for professional football beyond the NFL.

The AAF had eight teams in two conferences under one-entity, all in southern and western U.S. markets. Each team was located in a metropolitan area with at least one major professional sports franchise, except for the Birmingham Iron. Before tackling the X’s and O’s, let's rewind the tape. In 24 months, the Alliance rushed out of the locker room and installed a business that included formulating a league structure, staffing the front office and coaches both at league and team level, defining rules and officiating, organizing a team and logistics for a product on the field that resulted in only eight weeks of football exhibitions. Talk about a two minute drill.

“A lot of what this business is about is being an iceberg. You see about 10 percent of what the company is above water publicly.” – Charlie Ebersol, Co-founder and CEO of AAF

Hail Mary: The self-made Alliance strived to be a “minor-league” system to the NFL. Stacking their front office talent and coaching staff, leaning on many former NFL executives and alumni as advisors, like Pro Football Hall of Famer Bill Polian, television and film producer, Charlie Ebersol, four-time All-Pro Jared Allen and two-time Super Bowl Champions Troy Polamalu, Hines Ward, and Justin Tuck, and big-league football coaches like Steve Spurrier, Michael Vick, Mike Singletary, and Mike Martz. That’s a lot of Mikes. However, what was a major and not minor differentiator was that the NFL does not have a vested interest in the AAF.

Let’s shift the game here bit. Take the professional baseball system. In Minor League Baseball (MiLB), the footprint extends across 160 revenue generating clubs in 42 states affiliated with 30 Major League Baseball (MLB) teams. We could go long on this topic, but for the sake of not delaying the game, the extra point here is the cohesive effect in grooming talent within professional baseball stretches in an organized, affiliated farm system. The AAF had the potential to be a comparable developmental league nurturing quality players, but like many leagues in the past have tried, limitations exist due to clauses set forth by the NFL Players Association (NFLPA); making it difficult to be a true farm system.

The Alliance believed one of their biggest challenges was getting the big-name talent, and therefore wasn’t unionized, so each AAF player received a three-year, non-guaranteed contract worth $225,000. What’s ironic is the AAF had an “NFL-out clause” restricting players to go to the NFL during the term of their agreements. Which begs the question, how can a league aiming to be complimentary, limit the opportunity to sign on an NFL roster on a year-by-year basis? Talent is evaluated play-by-play in a quarterback driven league.

“If the players union is not going to give us young players, we can’t be a developmental league.” – Tom Dundon, chairman of AAF

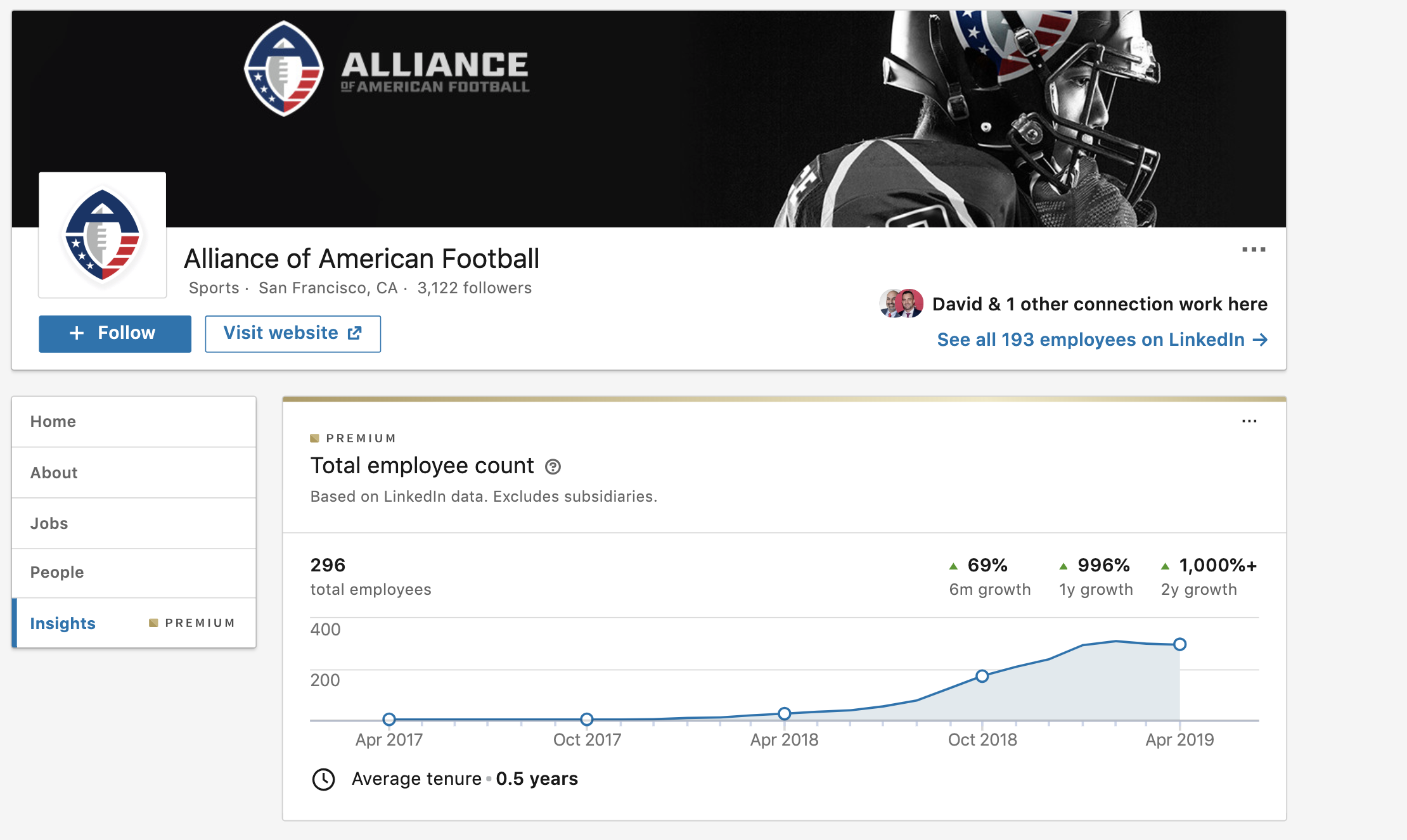

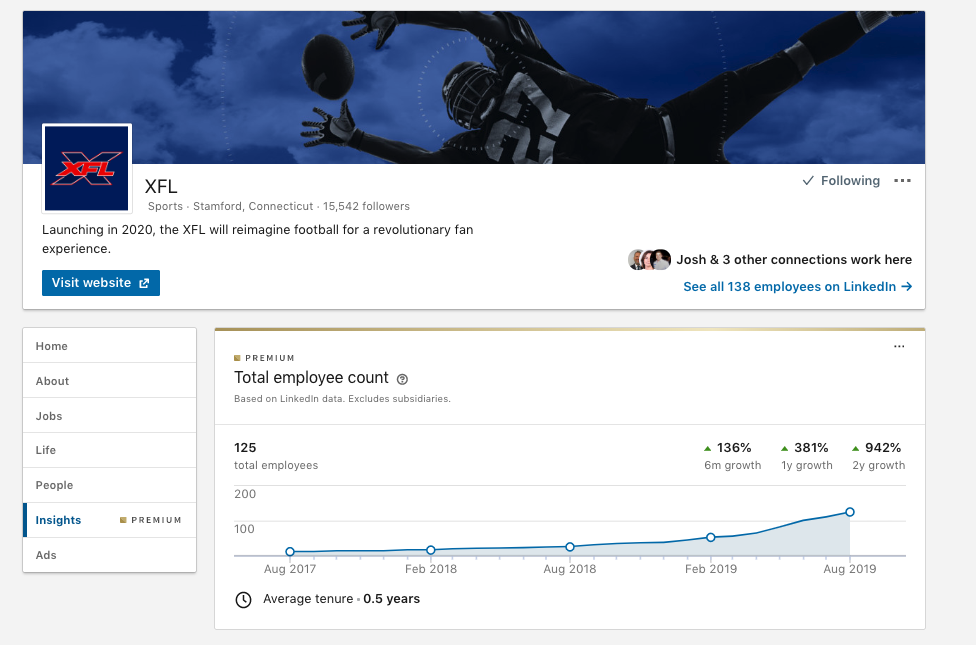

Too Many Men Off the Field: Enough about football. Let's get down to business. According to LinkedIn Insights, the AAF started with four employees in its infancy in April 2017. Nearly 18 months later, headcount quickly rose to more than 200 in the front office, and almost 300 by kickoff. The hiring spree for the league office, as well as its eight local teams was an all-man blitz strategy that ran a high risk. Scaling too fast translated to a low reward that unfortunately was one of the Alliance’s achilles that put them on injured reserve indefinitely.

Comparably, the XFL 2.0 will face similar business climates; however, the data suggests that the league's total employees by kickoff in 2020 will be almost half the headcount that AAF had at its current hiring trajectory. Within a 12-month span at pre-revenue stages, the Alliance nearly grew their headcount by three times as much as the XFL currently had. I know it's an early point in the game, but I'm going to toss out the challenge flag here. Filling a team roster on the football field should not be tackled with the same approach as beefing up your business structure. Lean, slow, and steady. Not bigger, faster, stronger.

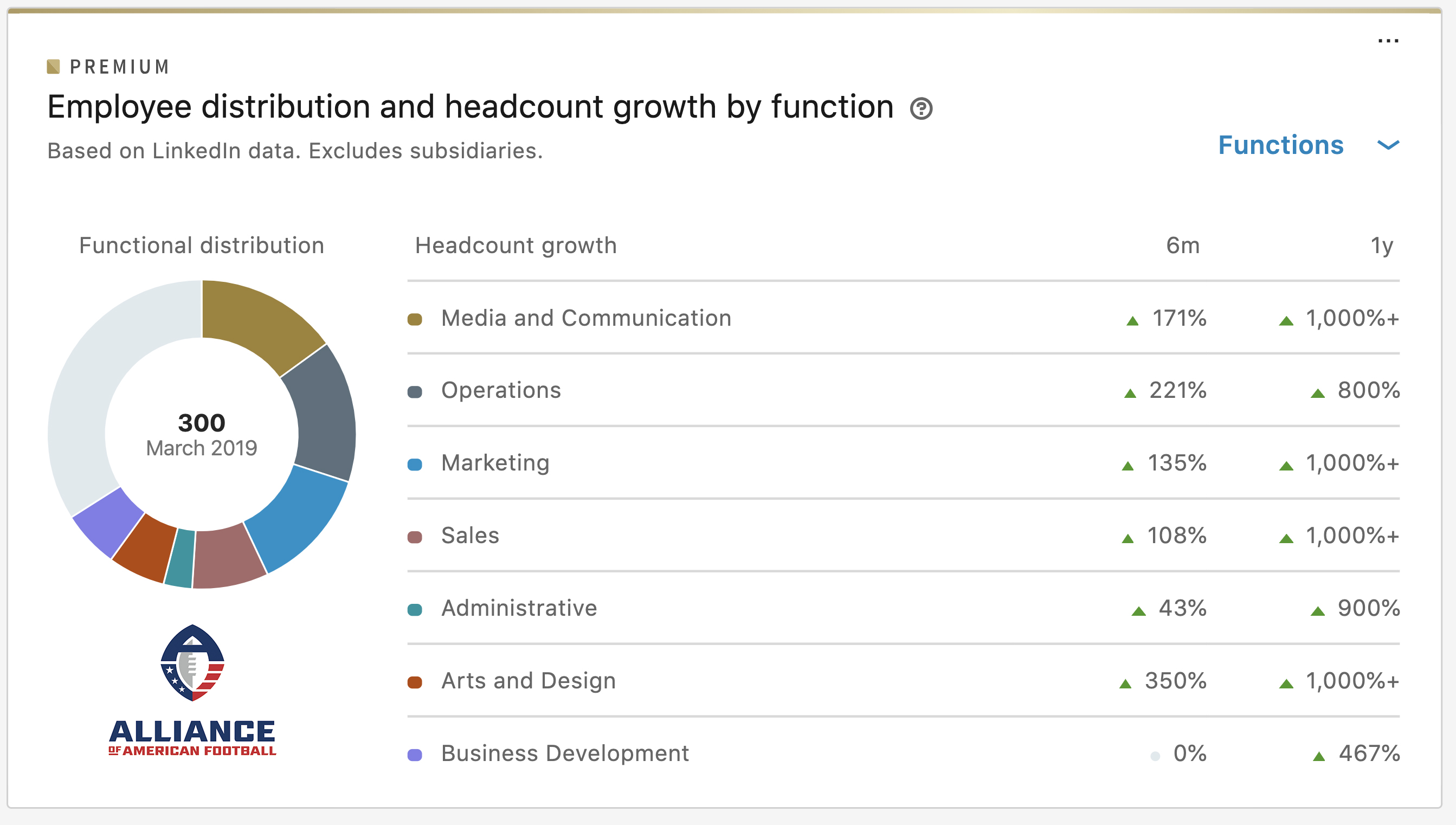

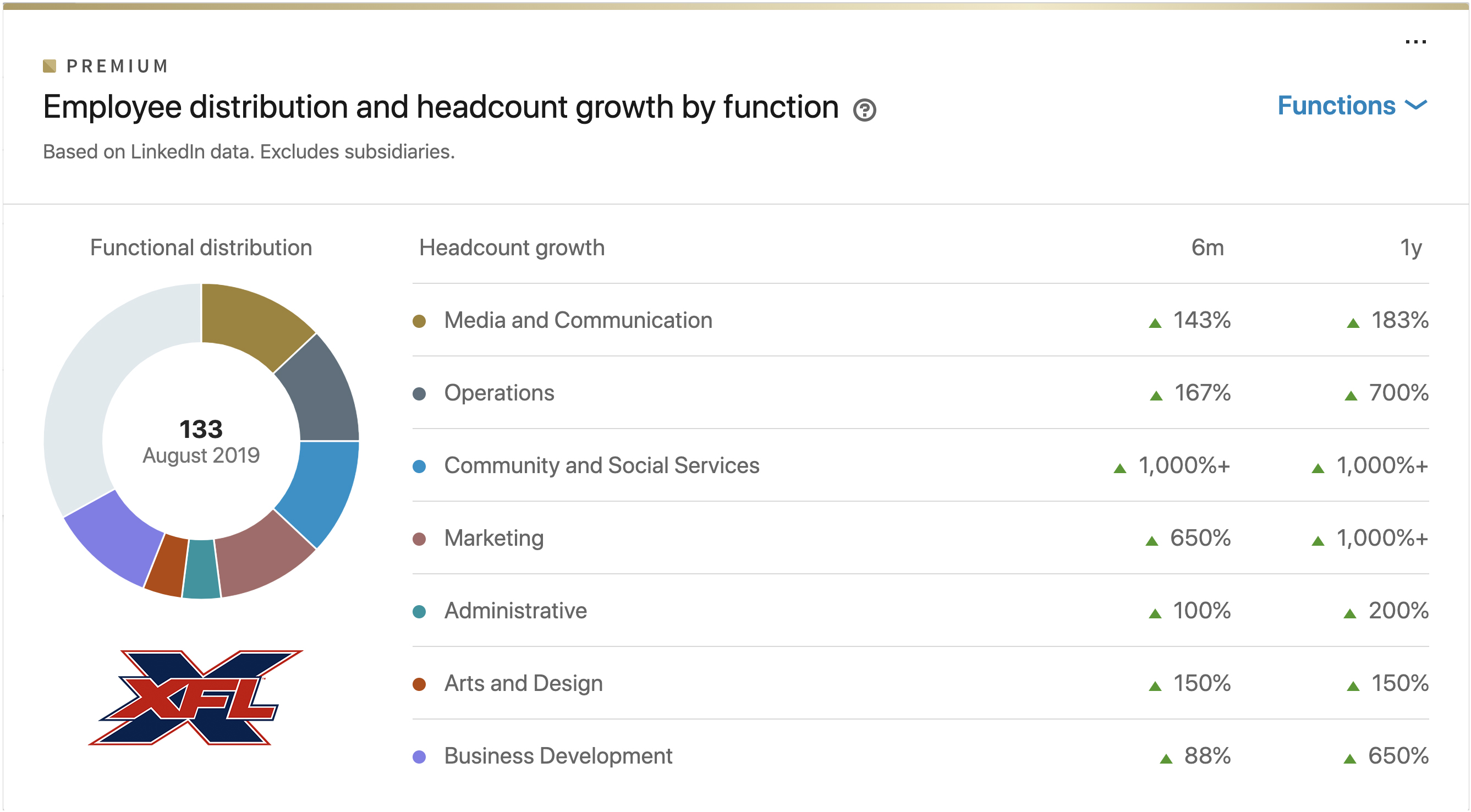

One-Sided Roster: Pound the rock, and run the football. Observing the functional distribution for the Alliance, you will notice one of the two smallest functional areas by employee were business development/sales and community and social services. These departments are considered the keys to the game to open up brand loyalty; and the observations imply a snapshot into the Alliance's priorities where there was a shortage of resources allocated into their community relations. The results of the game always indicate how it was played on the field. The infrastructure balance was one of the indicators for the league's inability to open lanes and connect with fans.

The XFL 2.0 on the other hand, based on the early numbers, seems to line up with a different playbook more in the style of offense I like to run. With the community building the foundation for a strong offensive line. Protect, block, and create opportunities for your playmakers will always be the difference maker. You got to give to get; and in forming success, your beneficiaries extend your brand beyond the backfield of attendees and viewers that will build a fan base and relationship with the community. Even with a lob-sided roster, it was clear that AAF's focus on brand equity was staffing up its front office like a fantasy football team instead of other focal points.

“This will revolutionize the way sport is produce and presented” - Vince McMahon, Founder of the WWE and XFL

The Media Arms Race: The AAF took a shot down the field leading in with a variety of TV partners. Although the AAF started off hot with nearly 2.9 million viewers tuning in week one, viewership leveled off fairly fast across CBS, TNT, and NFL Network, with little network coverage as all games averaged roughly 500,000 viewers. The Alliance had the right concept to spring with a wide-spread television reach; however, their programming felt a little scrambled. If the AAF was paying out of pocket for its TV time between the networks, then this is another example of the Alliance going long to ramp up its brand equity.

March was madness for the Alliance, being in a TV lineup that attempted to compete with the NCAA's March Madness, NBA, PGA, NASCAR, NHL playoffs, and MLB spring training; all in stride at a peak time of television entertainment. So, can professional spring football compete in the arms race for cable television? Entertainment is a commodity business and with an already saturated sports calendar and a limited amount of primetime slots available, football in the spring is just a bite of the overall TV market share.

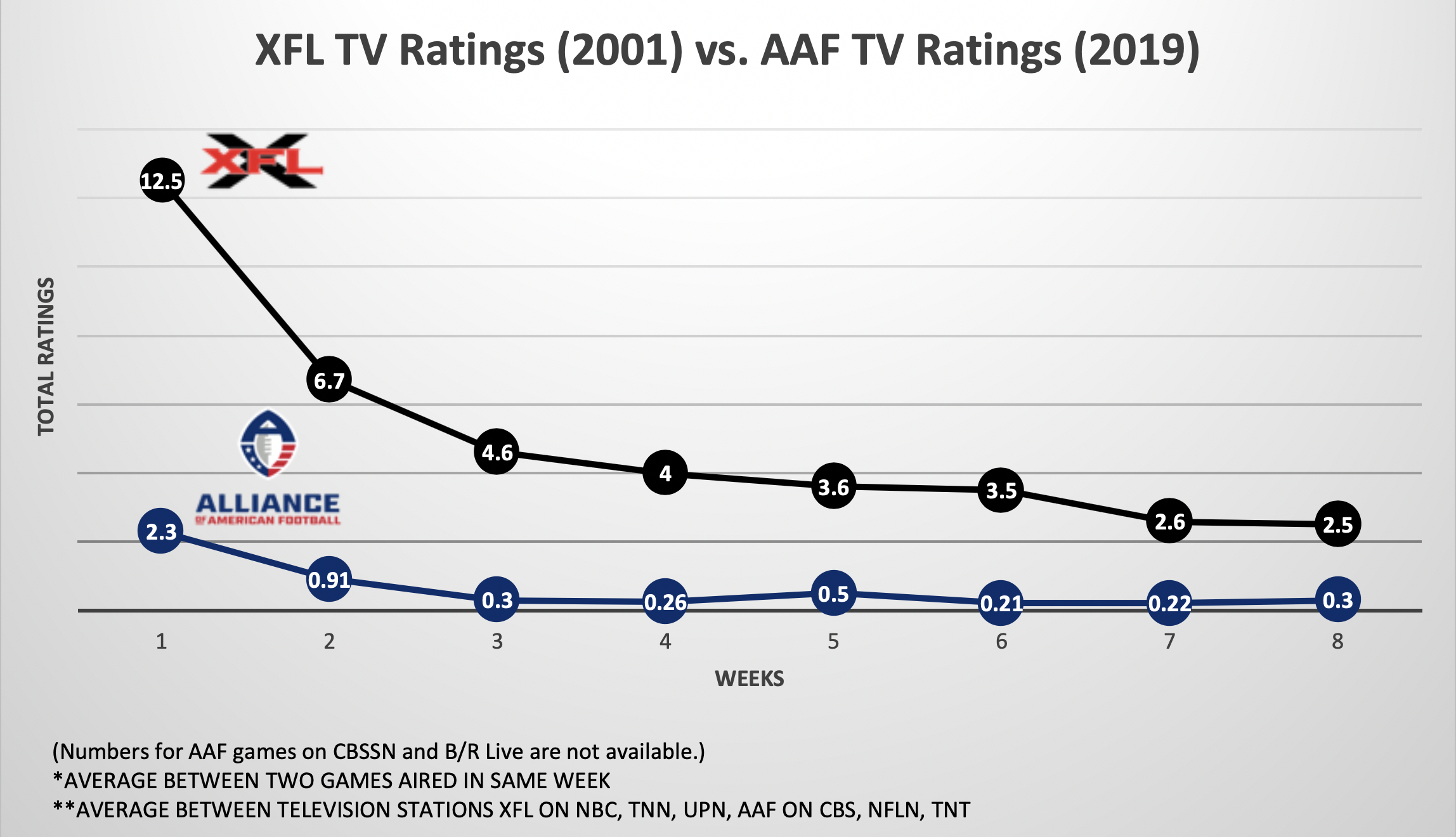

The AAF wasn’t the first, and will certainly not be the last, to shed some pigskin on this topic. For a sport vs. sport comparison, let's examine the original XFL's Nielsen ratings from 2001. The XFL had national and local television partnerships with NBC, TNN, and UPN. Ironically, Charlie Ebersol's Dad, Dick, was an executive at NBC Sports during that time. When the XFL debuted on that Saturday night in 2001, 54 million tuned in at an astonishing 9.5 rating on NBC alone, with another 17 million viewers and a 3.0 rating to follow on UPN's Sunday coverage. Taking a closer look over just eight weeks of broadcasts, the ratings of AAF trended similarly to the XFL, where viewership for spring football tailed back after the first week.

The sports broadcasting landscape has evolved since 2001, and in 2020 there will be a different arms race for media. NBC no longer holds the keys to the kingdom and ESPN isn’t your Dad’s worldwide leader in sports anymore, just Disney’s. Fox Corporation launched a variety of sports specific television networks, FOX Sports, FS1, and FS2 just within the past decade and arguably has the widest bandwidth enabling the network to compete for primetime sports outside of the usual mainstream media. The XFL 2.0 is reimagined indeed. Deciding not to run the ball with a 'bell-cow back,' not named NBC as they did in the past. This time, the XFL is a running back by committee style offense with their broadcasting partners that includes FOX, FS1, ESPN, and ABC. World Wrestling Entertainment (WWE) has its own network, and don't be surprised in the foreseeable future the infrastructure is in place where it's viable for the XFL to house its own network. You know, if doubling down is Vince McMahon's kind of strategy. Television is reborn in a new world of sports broadcasting beyond cable. When it comes to spring football, is sports streaming the viable option for growth?

Online streaming has become the new norm in the on-demand world we live in today. The Alliance diversified their broadcast platforms by live streaming on B/R, TNT, and partnering with over-the-top (OTT) sports streaming service. With the rise of streaming services like Netflix, Hulu, Roku, and Amazon's Fire TV Stick – this isn’t your Mom’s cable box anymore. We’ve seen professional leagues successfully utilize predominant streaming platforms to tap into newer and broader audiences like the MLB’s partnership with Amazon Prime and the NFL with AT&T TV Now (formerly DirecTV). The 2019 NBA Finals were even sponsored by YouTube TV, which again reinforces that entertainment is trending online. More eyeballs online will generate more advertising, and we've learned for startups, your customers are best found on the internet. The AAF was looking to speed up the game 45 minutes faster than what a NFL game broadcast is, resulting in 60% less advertising. A faster product on the field was a missed opportunity to create new commercial inventory both on television and online.

So, has cable television become the sports viewership for a pastime of leather football helmets? Increasing your bandwidth online has become a new measure added into the equation for sports league's success in the twenty-first century. More audiences with a convenient reach. Will the new age of watching a sporting event online compete with cable television? Perhaps, it’s capable. Sorry Mom. Although I don’t believe it will never fully replace cable in our plugged-in connected world, well at least in my lifetime. Moreover, we can't deny that social media will have some influence. Social media has proven to be the coessential metric in establishing a fan base online and in the stands.

Ready. Set. N-B-C: NBC and the WWE heavily promoted the original XFL as "not your Dad’s NFL." Facing familiar circumstances now and then, even the former President of the XFL, Basil DeVito, believed the idea of putting together a football league in a year was an "insane proposition." Can you imagine what you can do in two years?

"This is going to be a cakewalk if we are all in this together." - Dick Ebersol

In 2017, Charlie Ebersol directed an ESPN Films 30 for 30 documentary, "This Was the XFL." To better understand the AAF and XFL connection is understanding the relationship that extends as far back as the 1970's, Dick Ebersol helped build the foundation to what NBC Sports is today, like Sunday Night Football, and Vince McMahon, who wrestled the WWE into an empire. The two would pair up to create one of the best television and entertainment tandems in the business. In 1998, NBC once lost its media rights for the NFL and was in the hunt to draft a new kind of entertainment. Dick Ebersol, production genius, and Vince McMahon, entertainment hype artist, together formulated the XFL on NBC. The two produced television masterpieces that still influence the NFL today, like the introduction of the "sky-cam" and risqué production that achieved both the highest generated televised primetime sports event ever and the lowest all in the same season. This was the XFL.

Fast forward to today, a recent lawsuit brought against Charlie Ebersol highlighted that the television and film producer came with the idea to re-launch a professional football league shortly after filming the documentary and offered to purchase XFL's assets for $50 million, but Vince and Charlie could not come into an agreement. In 2018, the Alliance and XFL 2.0 announced their new leagues almost in unison in the spring of that year. Did the AAF feel motivated or pressured to organize a league too quickly?

Fumblerooski: For our next trick. Spring football has had a history of failures and even successes in our lifetime who aim to be complimentary or compete with the NFL. Here's the run around. The first to compete with the NFL was the World Football League (WFL) of 1974, which opportunistically formed during the NFLPA strike that jumped a number of players by offering competing salaries to the NFL. Next came the U.S. Football League (USFL) in 1982. The USFL competed directly with the NFL for airtime after switching from a spring/summer schedule to fall/winter, but never got to play a down ending in 1986. Of course, there was the XFL in 2001 lasting the one season. The WFL made a return in 2008, same intellectual property with a new ownership group this go around, but ended in the same result. The first to ever compete directly for television time with the NFL and lived to play another game was the United Football League (UFL) in 2009, but lasted four seasons. Today, there’s a significant increase of professional football leagues across the U.S. The market for football is here to stay, now more than ever. Here's an observation of the spike for notable spring professional football in the U.S. that are active today:

"In our system, there's really a limitless cap on what a player can make...money from the amount of bets placed on them is one of the ways." - Charlie Ebersol

The House Always Wins: The Alliance was founded on the idea to be a technology company and prior to kickoff, landed an exclusive deal with MGM. The AAF had plans to integrate live statistics combined with updated gambling odds for fans to access on mobile devices. A predictive gambling mobile application was being built as a potential precursor to a future in which bettors could wager on an upcoming play-by-play basis.

The MGM initially invested in the AAF's technology arm, Legendary Field Exhibitions, but included a provision in the deal that the casino would gain rights should the Alliance fold. Since the deal with AAF, MGM has had an increase in major professional sports gambling partnerships: NBA July 2018, NHL October 2018, MLB November 2018. As for the NFL, they seem like they're the Caesar's Palace kind of players. I hear the reception is great there! Companies like DraftKings and FanDuel are scaling success by partnerships through sports targeted media buys and sponsorships at the league and team level.

MGM revealed investing up to “$500-$750 million in betting technology.” The casinos seemed to have had more of a strategy in growing sports with an engaged fan base behind betting technology. I'll take those odds.

It's clear that these new and competing leagues will have to broaden the horizons integrating technology and gambling accessibility as a component to the fan experience to achieve growth. Just recently, Fox unveiled FOX Bet, the first media giant to shake up the balance in fair time into mobile sports betting. The Alliance had a reliable partner like MGM to power up its sports gambling effort, but it seemed the activation came short of a winning hand. Look for MGM or Fox to orchestrate a big bet in taking their technology to either an existing league or perhaps its own with an incorporation of betting technology that will redefine the game will be played. It's hard to bet against the house, right?

A quick glance at AAF's other business partnerships at a national and local activation standpoint seemed to have been the missing link in moving the chains. Besides the MGM relationship and Bitty & Beau’s Coffee, based in Wilmington, N.C., which was the official coffee of the Alliance, these were the only sponsorship deals we are aware at the league level. Coffee is for closers. The AAF also had several licensee deals, including ones with Wilson and Riddell. The disestablishment of sponsorship categories at the league and team level was a missed one in generating business and community support. The focus seemed largely dependent on getting the product out to fans, but sponsorship support was minimal for a league that had two years of planning. In addition, AAF had no reported significant charity beneficiaries or community partnerships. As we indicated earlier in regards to its employee allocation, there seemed to have been no effort in this department.

The Next Generation of Fans: As we've identified, Mom's cable box and Dad’s NFL aren't characteristics of the box score that matter in growing the sport of football. The youth sports market in the U.S. accounts for $17 billion compared to the NFL's $15 billion industry. The youth tournament, league, and club revolution is here to stay folks. Did the AAF miss an opportunity to appeal to little football fans? Got to love those Little Giants. The world's largest football and cheer organization, American Youth Football (AYF), is testament that the football and cheer youth segment is growing. AYF participation rates for all age groups are at an all time high and teams continue to expand its footprint. Youth football leagues like AYF should be a role model for how professional leagues can reach the youths and parents in developing meaningful relationships. Where can I invest?

The major professional leagues are very successful at plugging into the youth segment that’s essential within an ever-growing marketplace. AAF should have ripped a page out of the NFL playbook with its philanthropic reach and charitable support practices connecting with its communities. Let's take the NFL's Raiders that will be moving to a new market in 2020 to play in Las Vegas from Oakland. With the single outlier being that the AAF isn't a worldwide brand like the NFL, both opportunities share a similar blueprint in inaugurating relationships and making community impact in a new football town. The Raiders Foundation have been active in Vegas as much as they have been in Oakland during this time. With a team on the field that will kickoff next year in the Las Vegas Stadium, the foundation's efforts has been actively working in the community for the past three years. Philanthropy is the key in grounding brand loyalty and new fans. This is the future of football.

As for the XFL 2.0, I hope the lessons can be taken from the good the NFL does in the community and the botched kick the AAF had in connecting with "kitchen table fans" and engaging young athletes. The Alliance had 17 billion reasons to have focused efforts into these kind of community initiatives in targeting more youth organizations to grow their base.

"One thing on the $250 million -- that's enough to run this league for a long time." - Tom Dundon

Too Much Football to Fail: Let’s review the economics. The Alliance's initial investors included a group of PayPal Co-founder, Peter Thiel's Founders Fund, Slow Ventures, Peter Chernin's Chernin Group, Adrian Gentry's and Charlie King's M Ventures, Keith Rabois, Jared Allen, and Reggie Fowler. Fowler committed to fund $170 million to AAF, but actual funding equated to less than $30 million and now facing unrelated bank fraud charges. Crunchbase reports an initial $17 million funding as far as we know publicly, so other amounts for seed funding are disclosed.

With the AAF losing $10 million a week and the "league nearly missing payroll after week two," there was a need for an emergency $250 million investment as a last effort bailout pledged by Tom Dundon, owner of the Carolina Panthers and subprime auto loan financier; however, actual commitment was $70 million making him the majority owner. After Dundon bought the league just a few more weeks of play and learning that the NFLPA's disinterest in lending active NFL players, the league discontinued just 25 days before its championship game. This tickles a familiarity to the financial crisis of 2008, right?

The Alliance filed Chapter 7 Bankruptcy, with Dundon filing as an unsecured creditor due to the leagues "misrepresentation," reclaiming $11.4 million in assets, $48.3 million in liabilities, and $536,000 cash on hand. XFL made a bid for AAF's football equipment, but the winning purchase went to former arena football commissioner, Jerry Krurtz, who is looking to launch the Major League Football in Spring 2020. Too much football to buy.

"We hoped everyone would look at this as we did, as a brand-building business." - Vince McMahon

Overtime: It's time for football reimagined. The XFL is reborn. As the renewed XFL 2.0 is set to kickoff in 2020, Vince McMahon is taking money out of the ring and putting it on the field, as he sold $261 million of WWE stock to seed the birth of XFL's parent company, Alpha Entertainment. The XFL was once approached to merge with AAF, but it's clear the XFL is looking to reboot its own playbook. Nevertheless, the Alliance took lessons from the original XFL, and the XFL 2.0 will take lessons from the tape left behind by the Alliance. We've already noticed some of the XFL's more progressive agenda vs. the original league by ringing in teams around stronger TV markets. With the exception of New York and Los Angeles being a repeat of the original XFL locations, the deck is reshuffled. The eight XFL teams are all located within the Top 11 U.S. Designated Market Areas. The XFL is back in the ring of the media arms race and backed up with a $500 million deck. Only time will tell if McMahon's double down succeeds.

Due to already being at the end of regulation and in extra time, we did not dive deep into specifics of the analytics of attendance and social that coupled any unusual insight into the AAF's organic growth. The XFL has already shown signs of an audible in regards to getting butts in the seats. In May, XFL selected Elevate Sports, a joint venture of the San Francisco 49ers, Harris Sports and Entertainment, Ticketmaster, Live Nation, and the Oakview Group, to be their outside sales agency to support the ticket sales efforts. This was a good call by the XFL to relieve the burden initially by implementing a third-party sales arm that will contribute to just a fraction of their overall business more effectively. McMahon seems like he has plans for a different kind of football. Perhaps, even more opportunistic for the sports industry as a whole being the sole suitor willing to take on the NFL at a mass scale.

"The Alliance of American Football represents a fundamental shift in the way we approach professional sports." - Charlie Ebersol

Due to the AAF’s ongoing legal process, they have declined to comment. Although the Alliance folded, an allegiance for spring professional football isn’t going away. The film room is stocked with playbooks and tapes that are set aside for the next generation of both sports leagues and fans who are revolutionizing the way they want the game on-demand and why they want it. Football influences more than what we can see on the field as we have unfolded here, and once again put the business of sports under the spotlight. As we gear up for the 100th season of the NFL this week, allow me to officially close the chapter of the Alliance of American Football - thanks for the lessons learned and memories.

Now, who’s ready for more football?